Dynamics of China's Futures Market Opening with QFII Engagement

Release date:2024-11-18

Author:

The progressive opening-up policies of China have not only accelerated the integration of China's financial markets with the global economy but have also paved the way for a more inclusive investment environment. Key players in this dynamic include the Qualified Foreign Institutional Investors (QFII) and Renminbi Qualified Foreign Institutional Investors (RQFII), with their presence in the Chinese capital market growing steadily. As of June 2024, a total of 839 institutions, an impressive number, have been granted the status of qualified foreign investors. This influx of international capital extends beyond the stock market to include the futures market, a crucial pillar of the financial ecosystem, which has also attracted the attention of these discerning investors. This article seeks to elucidate the operational mechanisms, regulatory frameworks, and strategic considerations that shape the participation of QFII and RQFII entities. Furthermore, by examining the experiences and challenges faced by these investors, we aim to gain a deeper understanding of the evolving landscape of China's futures market and its implications for global financial markets. We hope to offer valuable insights into the opportunities and complexities inherent in the Chinese futures market, highlighting the interplay between domestic policies and international investment strategies.

Background and Development of QFII/RQFII Participation in Futures Trading

China first implemented the QFII pilot program in 2002. In May 2011, the China Securities Regulatory Commission issued the ‘Guidelines for Qualified Foreign Institutional Investors' Engagement in Stock Index Futures Trading’, allowing QFII to participate in stock index futures trading. At that time, the main purpose was to meet their asset risk management needs and not encourage arbitrage and speculative trading. With the gradual relaxation of policies and market demand, the investment scope of QFII/RQFII has been continuously expanded, not only limited to stocks but also expanded to include commodity futures, options, and other derivatives.

In March 2018, China officially opened trading of crude oil futures to foreign investors, becoming the first internationalized futures variety in China. In May 2018, iron ore futures introduced foreign traders for the first time. These two events undoubtedly marked milestones in the internationalization process of Chinese futures varieties. Since then, the internationalization variety sequence has become increasingly abundant, foreign traders have become more actively involved, and the quality of market operation has gradually improved. China’s futures market has steadily expanded its opening-up.

On September 25, 2020, the China Securities Regulatory Commission issued the ‘Administrative Measures for Domestic Securities and Futures Investments by Qualified Foreign Institutional Investors and RMB Qualified Foreign Institutional Investors’, merging the regulation of QFII and RQFII. In November 2021, the China Securities Regulatory Commission announced that QFII/RQFII can participate in the investment of three types of varieties: commodity futures, commodity options, and stock index options.

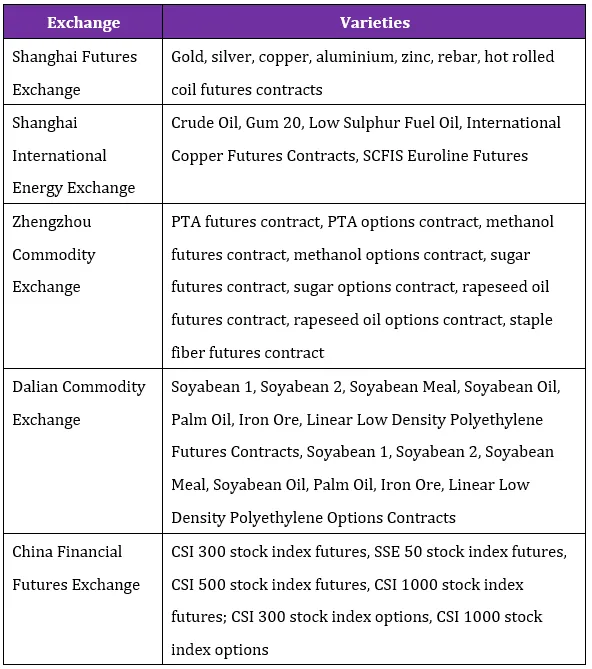

In September 2022, the Shanghai Futures Exchange and its subsidiary, as well as the Zhengzhou Commodity Exchange, Dalian Commodity Exchange, and China Financial Futures Exchange, all announced that QFII and RQFII were approved to participate in the trading of relevant futures and options contracts, involving 41 varieties in the first batch. Fang Xinghai, Vice Chairman of the China Securities Regulatory Commission, stated at the 2022 China (Zhengzhou) International Futures Forum that relevant departments will continue to steadily expand the opening-up of specific futures varieties, broaden the scope of QFII/RQFII investments, attract more foreign institutions to fully participate in the pricing of primary product futures varieties in China, enhance the representativeness and influence of Chinese futures prices, and actively explore new paths and models for opening-up under controllable risks. From the issuance of policies to the first transaction, the market only waited for a little over a month. On October 11, 2022, UBS Futures announced the completion of the first domestic commodity futures transaction by QFII/RQFII and became the first futures company to support QFII’s participation in the domestic commodity futures market.

On November 10, 2023, the People’s Bank of China and the State Administration of Foreign Exchange issued the ‘Administrative Provisions on Funds for Securities and Futures Investments in China by Foreign Institutional Investors (Draft for Solicitation of Comments)’, further simplifying and shortening the entry process for QFII/RQFII to participate in the domestic securities and futures markets.

From the development process of QFII/RQFII, the entry standards have gradually relaxed, and the range of investment targets that can be participated in has expanded. The establishment of the QFII/RQFII system is undoubtedly one of the important symbols of China’s capital market opening-up. Although foreign investors can also participate in the domestic securities and futures markets through channels such as Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect, compared to those channels, the range and variety of securities and futures available for purchase through the QFII/RQFII route are more extensive and diverse.

Currently futures varieties open for trading by QFII/RQFII in China

Varieties of Futures Trading for QFII/RQFII Participation in China

Currently, the investments that QFII/RQFII can engage in on securities/financial futures exchanges include: 1. Stocks, including common stocks, preferred stocks, and other stocks recognized by the stock exchange; 2. Exchange-traded bonds, including government bonds, pre-issued government bonds, local government bonds, corporate bonds, enterprise bonds, convertible corporate bonds, detachable convertible corporate bonds, exchangeable corporate bonds, small and medium-sized enterprise private placement bonds, policy financial bonds, subordinated bonds, and other bond varieties recognized by the stock exchange, as well as bond repurchases; 3. Exchange-traded funds, including various types of exchange-traded open-ended index funds (ETFs), closed-end funds, open-end funds, money market funds, and other fund varieties recognized by the stock exchange; 4. Stock index futures; 5. Exchange-traded stock options; 6. Warrants; 7. Asset-backed securities; 8. Participation in the subscription of new stock issues, bond issues, stock rights issues, and bonus shares; 9. Other securities varieties permitted by the China Securities Regulatory Commission.

Looking back at 2022 when QFII/RQFII were allowed to participate in trading futures and options, a total of 41 related varieties could be traded, including gold, silver, low-sulfur fuel oil, methanol, white sugar, soybean meal, soybean oil, and other commodity futures, as well as copper, aluminum, zinc, methanol, white sugar, and stock index options. It is worth mentioning that among the aforementioned varieties, there are nine internationally standardized varieties, including crude oil, low-sulfur fuel oil, TSR 20 rubber, iron ore, PTA, international copper, palm oil, crude oil options, and palm oil options. Judging from UBS Futures completing the first domestic commodity futures transaction and becoming the first futures company to support QFII participation in domestic commodity futures trading, it is evident that foreign investors have a strong interest in the aforementioned varieties, indicating the sustained attraction of the Chinese futures market to foreign capital. Internationally standardized varieties also exhibit significant activity and liquidity in the market that cannot be overlooked.

Current Policies and Measures on the Implementation of Opening up the Futures Market in China

The opening of China's futures market to the outside world has significantly enhanced its attractiveness to international investors, and the relevant regulatory bodies have duly introduced a series of policies and measures with a view to accelerating the pace of the opening of China's futures market to the outside world. The specific policies and measures for opening up China's futures market to the outside world mainly include the following aspects.

1. Variety Opening: As of now, China has introduced 24 specific domestic varieties to foreign traders. QFII/RQFII can participate in trading 46 futures and options varieties.

2.Tax Preferential Policies: To support the opening up of commodity futures markets, the Ministry of Finance and the State Taxation Administration have issued the ‘Notice on Temporary Exemption of Corporate Income Tax on Income from Transfer of Equity Investment Assets Including Shares Within China by QFII and RQFII’, providing tax incentives for bonded delivery of commodity futures varieties approved by the State Council for opening up. In addition, since the opening up of crude oil futures, income obtained by overseas individual investors from investing in domestic crude oil futures is temporarily exempt from individual income tax for three years from the date of opening. Currently, this policy has been extended until December 31, 2027.

3.Financial Sector Opening Measures: Although some financial sector opening policies are not specifically targeted at the futures market, as part of the financial industry, such policies also have a significant positive impact on the internationalization process of the futures market. For example, foreign institutions are allowed to conduct credit rating business in China, they can rate all types of bonds in the interbank bond market and exchange bond market; encourage overseas financial institutions to participate in the establishment and investment in commercial bank wealth management subsidiaries, etc.

4.Financial System Innovation in Free Trade Zones: China's free trade zones, which have been officially launched, have conducted pilot innovations in various financial systems, and reforms related to the futures market are also underway. These reforms include bonded delivery of futures, introduction of overseas enterprises to participate in trading specific variety futures, exploration of innovative exchanges, and establishment of futures subsidiaries to conduct risk management business, etc.

5.Reform of the QFII/RQFII System by the People's Bank of China and the State Administration of Foreign Exchange: The People's Bank of China and the State Administration of Foreign Exchange have also continued to intensify their reform measures by further simplifying and shortening the entry process for QFII/RQFII participation in the mainland securities and futures market through recently released regulations. This move further deepens the reform of the foreign exchange management of QFII/RQFII and primarily pushes forward the unification of the rules of fund management of the onshore open channels of the financial market, thus facilitating the promotion of China's financial opening to the outside world and market efficiency. Specific bright measures can be summarized as follows.

5.1 The 20% proportion limit on capital repatriation and the requirement for principal lock-up period have been removed, and QFII/RQFII are allowed to hedge their domestic investments with foreign exchange derivatives.

5.2 Key reform contents include simplifying registration procedures, optimizing account management, streamlining exchange control management, and facilitating foreign exchange risk management.

5.3 The previous restrictions on the number of brokers and custodians have been removed, allowing QFII to conduct financial transactions based solely on their business needs.

5.4 International organizations have been added as investor types, while the expression "other asset management institutions" has been removed from the consultation draft.

5.5 The provision prioritizing long-term institutional investors such as pension funds and charitable funds has been deleted.

In summary, the specific policies and measures for the opening up of the futures market in China cover various aspects such as variety opening, tax preferential policies, and financial sector opening measures. In addition, the innovative financial system in free trade zones, as a distinctive and innovative policy, has greatly promoted the international development of China's futures market and enhanced the competitiveness and influence of China's futures industry in the global financial market.

Major Challenges and Solutions Facing the Opening-up Process of China's Futures Market

During the process of opening up the futures market, various challenges and issues are inevitable. From the perspective of restricting the opening up of China's futures market, the main challenges can be summarized as follows: low degree of market internationalization, relatively high market access thresholds, insufficiently smooth two-way communication, cumbersome and opaque procedures, and the need to solidify market infrastructure, among others. Furthermore, the legal system and regulatory framework of the futures market are not yet sound, the types of listed futures trading varieties need to be further increased, the standardization level of brokers' operations is not high, and the excessive restrictions on domestic and foreign hedging activities by trading entities are also important factors restricting the development of the futures market.

On the other hand, from the perspective of potential problems that may arise from the opening up of the futures market, issues such as rapid capital account opening leading to large-scale short-term cross-border capital flows, incomplete marketization of the RMB exchange rate, immature financial regulation, and weak market risk resistance are potential risks associated with rapid development. Additionally, the significantly higher entry barriers for foreign investment in China's financial industry compared to OECD countries and the high competition barriers are also major obstacles affecting the opening up of China's futures market and the entire financial industry. We summarize the specific challenges as follows:

1.Optimization of Market Participant Structure:

China's futures market participants are primarily small and medium-sized retail investors. Although there has been some improvement in recent years, there is still a significant gap compared to international markets. The structure of market participants in the futures market determines the authority of market pricing, and the degree of corporate market participation determines the pricing power of enterprises in the market. There is a need to further enhance the proportion and pricing power of enterprises and financial institutions in the structure of futures market participants.

2.Weak Foundation of the Spot Market:

China's futures market did not develop naturally from the spot market but was driven by the government under semi-market conditions. This has led to a weak connection between the futures and spot markets, and a weak foundation of the spot market, affecting the development and functional role of the futures market.

3.Challenges in Internationalization Target Positioning:

The core goal of the futures market's internationalization should be to serve the actual needs of physical merchants (real economy) in cross-border trade, help them manage risks and discover prices, and actively compete for international pricing power for bulk commodities. However, the advancement of futures market internationalization requires a balance between opening-up pace and risk management, and should not be rushed.

4. Complexity of Cross-border Regulation and Cooperation:

With the opening-up of the futures market, cross-border regulation and cooperation have become particularly important. It is necessary to strengthen the capacity for cross-border regulation, enhance the monitoring and analysis of cross-border trading behavior and capital flows in the futures market, and maintain the overall safety and stable operation of the futures market.

5.Polarization in the Internationalization of Futures Companies:

The performance of domestic futures companies is polarized, with many barely managing operations and lacking the capacity to engage in internationalization; while leading futures companies are active in cross-border business and accelerating their international layout. However, overall, futures companies have single business types, small scale, and weak competitiveness, making it difficult to fully meet the needs of internationalization.

6.Lag in Institutionalization and Legal System:

China has long been lagging in regulations for cross-border derivative transactions compared to actual trading scenarios. There are many legal blanks in terms of foreign investors entering the domestic futures market, leading to a series of policy arbitrage spaces, affecting the quality and depth of futures market internationalization.

7.Increase in Macro Risks:

The internationalization of the futures market may affect the balance of international payments and exchange rate stability, weaken the effectiveness of price regulation, increase the risk of short selling, and the cross-border transmission of investment risks. These risks need to be controlled through reasonable policy design and risk management mechanisms.

8.Operational Risks of Futures Companies:

Futures companies, as the link between domestic and international futures markets, are the most directly exposed market entities in the internationalization of the futures market. Futures companies are weak in domestic development and have weak risk resistance, necessitating cautious development of international business.

To address the aforementioned issues that may exist in China's futures market, we believe improvements can be made in the following aspects:

1. Optimize market access mechanisms and adopt flexible access conditions:

Implement negative list management, reduce market access thresholds, optimize market access procedures, and improve corresponding risk control mechanisms. In addition, while ensuring market stability and controllable risks, appropriately relax access thresholds to attract more investors to participate in China's futures market while ensuring the orderly development of the market.

2.Increase trading varieties and innovate trading mechanisms:

Accelerate the reform of the listing system for varieties, establish a market-oriented listing mechanism, continuously increase new trading varieties to meet the hedging needs of market entities. Meanwhile, efforts should be made to increase research and development of new varieties, promote the integration of futures and spot markets, and encourage innovation in futures companies' business.

3.Strengthen international cooperation and exchanges:

Explore the participation modes, access thresholds, entry processes, and related supporting policies for overseas institutional investors, such as foreign exchange, taxation, and bonded delivery. Additionally, lessons should be drawn from mature systems of foreign regulatory authorities, absorb experiences, and form a trading system with Chinese characteristics. By enhancing international cooperation, the international competitiveness of China's futures market can be improved, and the sustained healthy development of the capital market can be promoted.

4.Accelerate the construction of laws and regulations:

Improve the legal system construction of the futures market, gradually form a regulatory system dominated by market self-discipline; meanwhile, strengthen financial supervision, enhance market resistance to risks, and ensure the coordination between financial opening-up and domestic financial stability.

5.Increase trading varieties and innovate trading mechanisms:

Accelerate the reform of the listing system for varieties, establish a market-oriented listing mechanism, continuously increase new trading varieties to meet the hedging needs of market entities. Additionally, improvements and enhancements can be made in increasing research and development of new varieties, promoting the integration of futures and spot markets, and encouraging innovation in futures companies' business.

Through these measures, the healthy development and internationalization process of China's futures market can be promoted while ensuring financial stability.

Conclusion

Since the opening of China's futures market to the outside world, its attractiveness to international investors has increased significantly. The accelerated promotion of the pace of opening to the outside world by the regulators marks the further deepening of the two-way opening of China's futures market, which helps to enhance the attractiveness of China's futures market to foreign qualified investors and improve international influence. The introduction of laws, regulations, policies and other documents such as the Futures and Derivatives Law of the People's Republic of China has guided the development of the futures market and opening up to the outside world, providing attractive investment opportunities for international investors. In addition, foreign institutions and traders can share the dividends of China's economic growth through participation in China's futures market, achieve a diversified investment layout, and gain advantages from market opening and standardization.

In reviewing the history of China's futures market opening up to the outside world, it can be seen that this development process is not only an important part of the opening up of China's financial market, but also a key step in promoting the internationalization of China's capital market and enhancing its international competitiveness. From the listing of crude oil futures in 2018 to the subsequent opening of a number of varieties to foreign investors, to the recent initiatives to further expand the opening of specific varieties and broaden the investment scope of QFII/RQFII, the opening up of China's futures market to the outside world has continued to accelerate, signaling that the opening up of China's financial market to the outside world has entered a new stage. This series of opening-up measures not only helps to attract more international investors to participate and enhance the representativeness and influence of China's futures prices, but also provides richer comprehensive hedging tools and risk management services for the development of China's real economy. Meanwhile, through the introduction of foreign-funded financial institutions and the promotion of financial infrastructure interconnection, China's futures market regulations and basic systems have been brought into line with international advanced experience and improved, and the industry's supervisory capacity has been significantly enhanced, laying a solid foundation for the healthy development of the market.

It is, however, also not to be neglected that, in the face of the complex changes and challenges in the global financial market, China's futures market, while continuing to promote opening-up to the outside world, is also faced with the problems of how to balance the dividends of opening up with the potential risks and losses, how to further improve the market regulatory system, and how to strengthen international co-operation to cope with the common challenges. Therefore, the future development of China's futures market still requires adherence to the direction of marketisation, rule of law, and internationalization, continuously deepening reforms, improving institutional design, enhancing service quality, to better serve the real economy and promote the sustainable and healthy development of China's capital market.

Related Lawyers